Summary

One of the most basic features in BrightSide is also one of the most misunderstood; escrow. This article is here to help shed light on how to use escrow in our app.

The Basics

What is Escrow?

If you have been managing short term rentals for a while, the odds are good that you know a few things about escrow accounts. However, for the uninitiated, here is a brief introduction. The majority of property management companies keep an escrow account and an operating account at their financial institution. Moneys received as deposits, i.e.: money that could possibly be refunded, and is thus “unearned,” remains in the escrow account until it is either refunded or earned. Once the money is considered earned, it is moved into the operating account.

What Goes Into Escrow?

Reservation Deposits & Payments

As mentioned above, when a guest pays a deposit against a reservation, BrightSide places it in “escrow” status. After all, the guest may cancel their reservation and you must return all, part, or none, of the deposit, depending on your cancellation policy. Deposits are not considered earned income in BrightSide until after a completed stay. This money is held in escrow until BrightSide automatically moves it after check-out.

When a reservation is booked and a deposit is paid, the deposit may include a number of items, including rent, fees, travel insurance, taxes, etc., depending on your settings. All of this money goes into escrow.

NOTE: When a reservation is cancelled, retained funds remain in escrow until you manually move it to your operations account.

Viewing Money in Escrow

Advance Deposits Report

All moneys received from a guest, or on a guest’s behalf, are automatically placed in escrow status within BrightSide. These funds remain in escrow until the stay is completed and the guest is checked out. After check-out, BrightSide automatically moves the funds out of escrow and into earned income status. The Advance Deposits Report lets you see the funds remaining in escrow.

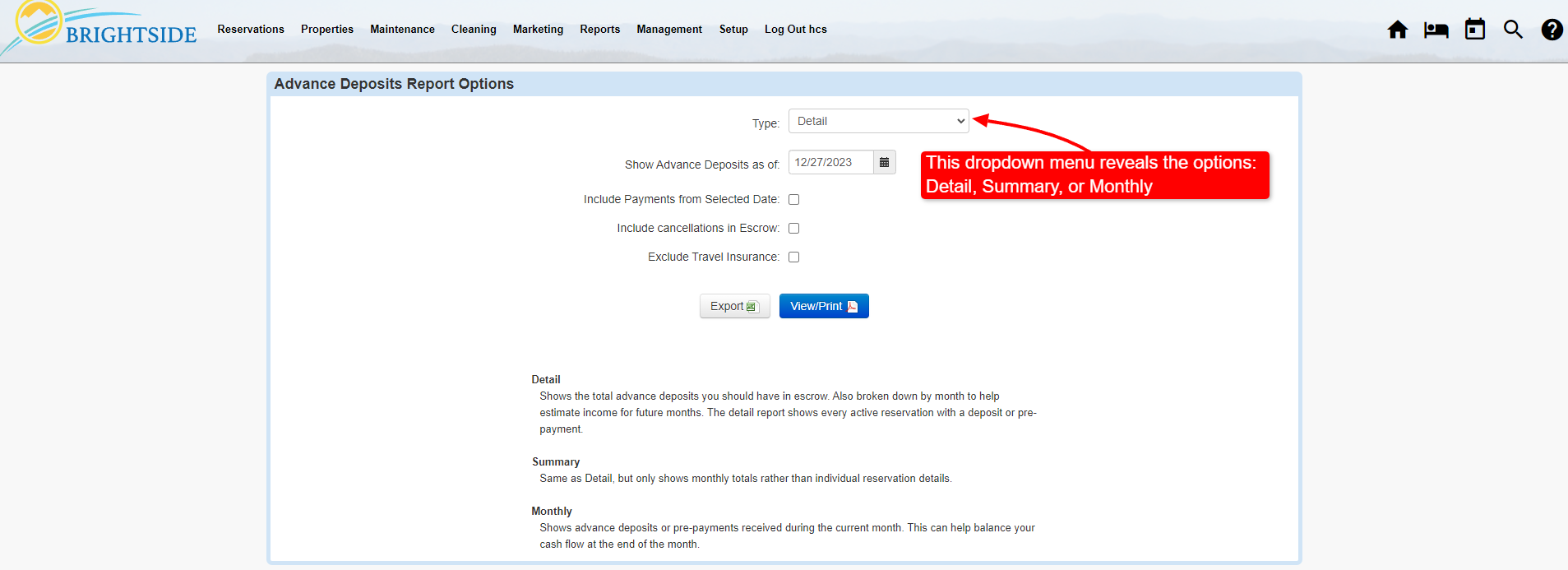

BrightSide offers several options for running this report:

- Detail – Shows the total advance deposits you should have in escrow. This report is broken down by month to help estimate income for future months. It also includes the departure date, reservation number, unit, guest’s name, and total deposit for each reservation. The detail report shows every active reservation with a deposit or pre-payment.

- Summary – This report option only shows monthly totals rather than individual reservation details. It includes departure month, stays, nights, and total paid.

- Monthly – Shows advance deposits or pre-payments received during the current month. This can help balance your cash flow at the end of the month. It includes the date received, reservation number, departure date, unit, guest’s name, and amount paid.

The Advance Deposits Report also allows you to include payments from a selected date, cancellations in escrow, and exclude travel insurance, if needed. This report may be exported to an Excel file for sorting or printed as a PDF.

NOTE: Reservation deposits from all sources go into escrow, including Airbnb, Vrbo, Booking.com, direct bookings, etc.

Cancellations in Escrow

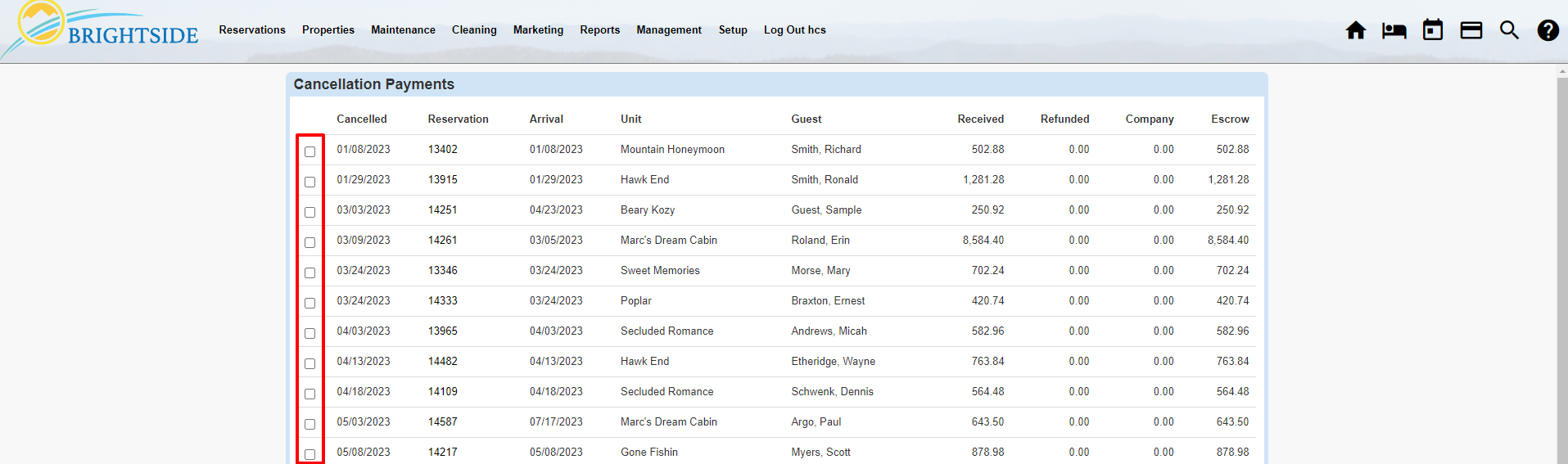

Outstanding Cancellations

Unfortunately, guests cancel reservations. When they cancel, BrightSide places those reservations in cancelled status and the unrefunded part of their payments remain in escrow. To view all of the cancelled reservations, you may run a report that includes the reservation number, the date it was cancelled, the arrival and departure dates, unit, guest’s name, and the amount they paid.

NOTE: When you want to move the funds from a cancelled reservation out of escrow and into your operations account, go to Pay Out Cancellations.

Escrow Cash Flow Report

Summary

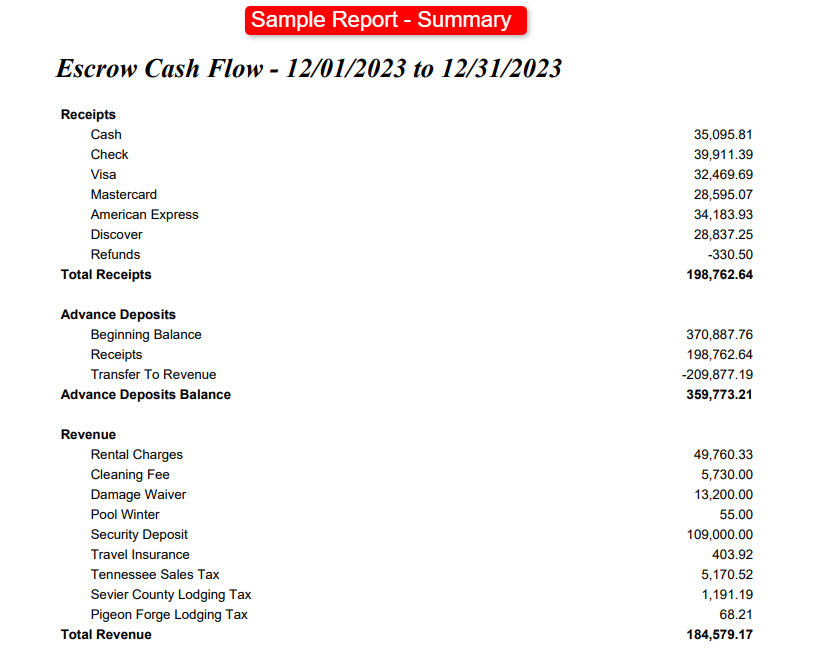

The Escrow Cash Flow report is available with two options, summary or details. Option one is a summary report, normally a one page document with total receipts broken into categories. You can see in the sample report below that we have broken the receipts category in a number of subcategories including, Cash, Check, Visa, Mastercard, American Express, Discover, and Refunds.

We also have a section for Advance Deposits that shows a beginning balance, a receipts line, and the amount transferred to revenue (or earned income).

The third section on the summary report provides totals for each source of revenue. For example, in the screenshot below you can see Rental Charges, Cleaning Fee, Damage Waiver, Pool Winter, Security Deposit, Travel Insurance, Tennessee Sales Tax, Sevier County Lodging Tax, and the Pigeon Forge Lodging Tax.

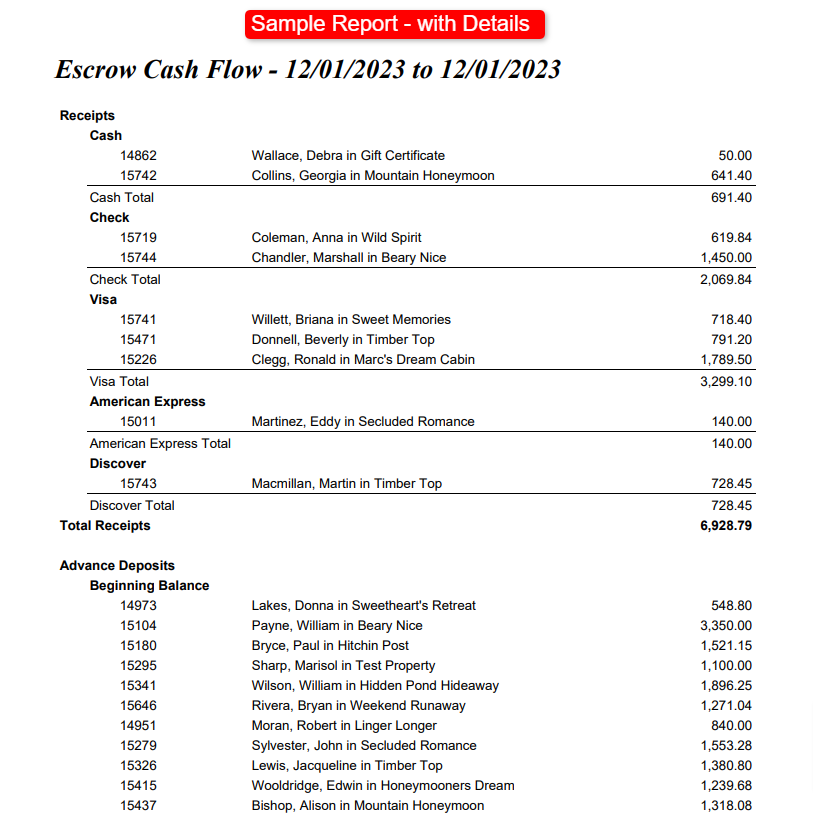

Details

Option two is a report with cash flow details, turning this into a document that can be dozens of pages long. The screenshot below does not include everything in this detailed report. However, it does provide a sample of what you may expect.

Escrow Reconciliation

Worksheet

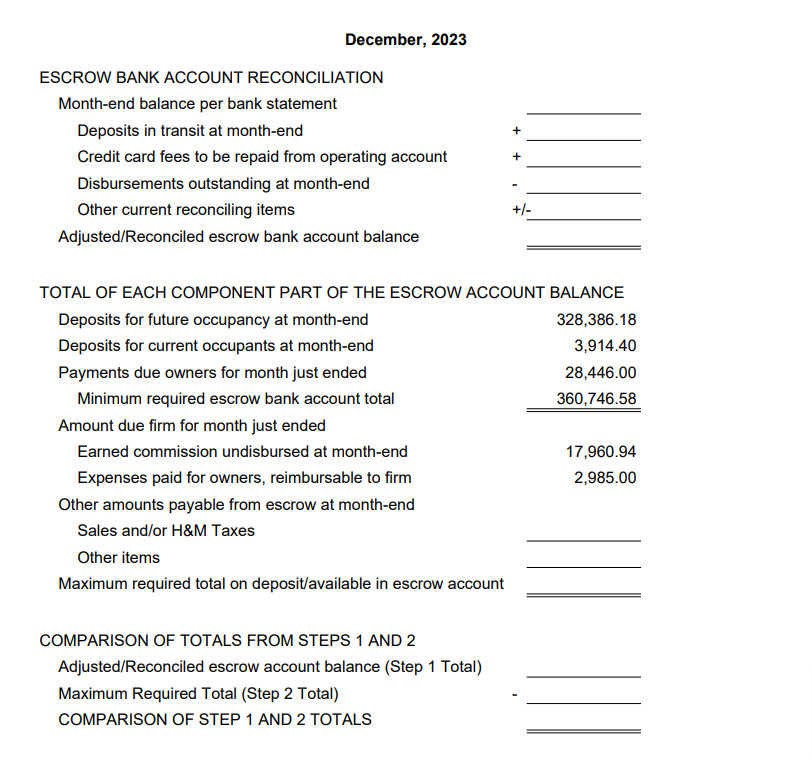

After closing out the month, you may want to reconcile your escrow bank account with BrightSide. Think of BrightSide as your written record, sort of like a checkbook register. You want to reconcile BrightSide and your escrow bank account to ensure that everything balances. To make this easier, we provide a reconciliation worksheet.

Moving Funds Out of Escrow

Pay Out Cancellations

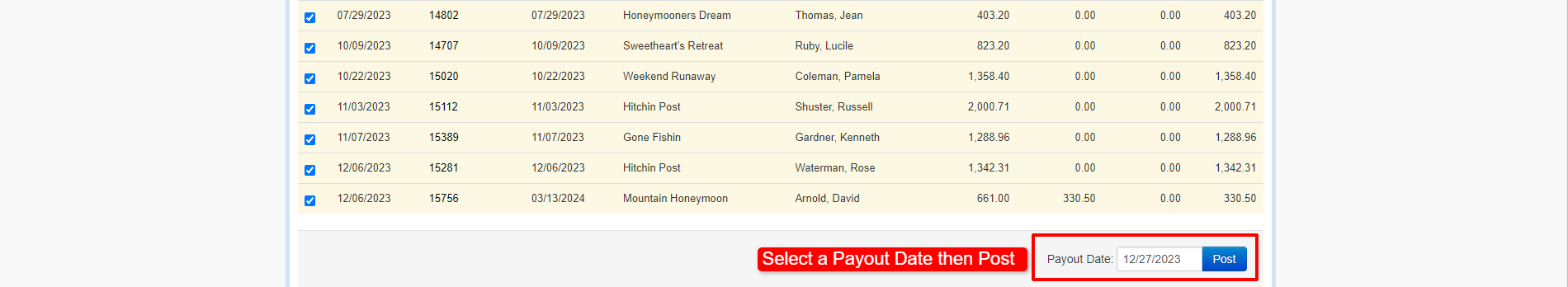

Keep in mind, when a reservation is taken and a deposit and subsequent payments are received, that money is kept in escrow until the guest checks out. However, if a reservation is cancelled, a rebooking is not possible, and money is retained by the property management company, these funds need to be moved out of escrow and into earned income manually.

To move money out of escrow and into earned income go to: Management > Pay Out Cancellations and follow these instructions.

- Tick the box next to the reservation from which you want to transfer the funds.

- Select a Payout Date at the bottom to record when the transfer was made.

- Click “Post”

That is all there is to it. Now the funds are out of escrow and into the earned income account.